Model for stock market beginners

What do I do first? How much money do I need? Is now a good time to start? What are the risks? How much time will it take? These are all good questions. This may not seem like much, but if you are turning over a lot of trades it all adds up. Other costs such as guaranteed stop-loss orders are often also set fees regardless of trade size. Another problem with a small amount of capital is you are restricted as to how many positions parcels of shares you can hold.

This, in turn, makes managing your risk more difficult. There are two types of stock broker or share broker , full service and discount.

I prefer using a discount broker which usually means you can do your trades online without talking to a human. Being able to trade without talking to a human broker also avoids you having to hear their opinion about the actions you are taking and therefore affecting your own psychology. Before online broking was available, my broker was on strict instructions from me to take my buy or sell orders without making any other comments about my trading choices.

Mentally, I tried to imagine him as an order-taking robot with cool lasers for eyes… To see who we recommend to be your broker, click here.

There are generally two types of analysis you can employ — fundamental and technical. I am an advocate of technical analysis. I usually ignore all fundamental analysis as it is unclear what actual effect the often subjective fundamental information will have on the share price. Also fundamental data is notoriously difficult, if not impossible, to quantify when comparing different stocks.

Technical analysis, on the other hand, relies on looking at what is actually happening now and can give insight into the market psychology that is occurring.

Investing for Beginners Resources and Advice

To scan the market for buying and selling opportunities from a technical point of view you will need a charting program for your computer and a source of share price data. You could use something as simple as a spreadsheet program on your computer or an off-the-shelf record keeping program such as Trade Trakker.

Having good record keeping lets you know where you stand at any given moment and also helps your accountant at year end work out your situation with regards to tax. The premise is that several entrepreneurs or wannabes pitch their business ideas to five wealthy investors to gain financial investment in exchange for a stake in their fledgling companies.

As I watched, a distinct pattern emerged. Those who had a hobby or interest they thought they should be making money from fronted up asking for financial help but most often had flimsy, pie-in-the-sky figures, no research and a lightweight business plan. Then there were the fewer true entrepreneurs who had a solid business idea, a well thought out business and marketing plan, robust research and a sound grasp of their finances.

In almost every case where this was demonstrated one or more of the wealthy investors took a stake in the enterprise. If you want to be successful as a trader you will need to have a written trading plan.

By mapping out what you want to achieve and the procedures you will follow to get there, you will, over time, produce greater profits than losses. Your plan should include things such as your goals and objectives, your trading system and procedures and how you will measure your performance. What will you do when you go on holidays?

What accounting structure will you trade under? How will you handle a windfall profit? All of this needs to go in your trading plan. Once you have a plan, you then need to follow it. Louise has a great trading plan template available through the Trading Game. As I mentioned, I use technical analysis to find my buying and selling opportunities.

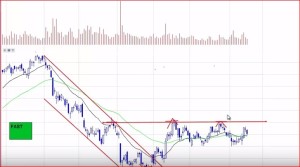

Technical analysis, you may recall, relies on looking at share price and volume information to determine the market psychology that is driving the trends in the markets and using that analysis to form a view on likely future stock behaviour.

Charts display the underlying emotion of the market participants. If the people are predominantly feeling fear that they will lose capital or profits, the share price will decrease and if there is an underlying feeling of greed or hope the price will increase.

The most common form of charts used are bar charts and candlestick charts. Each single bar on a bar chart displays the opening price, the high and low for that period, and a closing price.

The vertical line displays the high and low and the horizontal line at the left represents the opening price and the line at the right the closing price. On a daily chart the bar represents one day of trading. Of course you can use shorter and longer time periods for your charts — anything from 5-minute to monthly, or even yearly!

Candlestick charts display the same information as bar charts but present a different graphical image. When the closing price is higher than the opening price the body is shaded green or white on a black and white chart and when the closing price is lower than the opening price the body is shaded red or black.

This single period of information looks like a candle with a wick — hence the name. Also trends are observable not only by direction but by colour. For this reason I prefer to use candlestick charts in preference over bar charts. Now we can use the charts to compare different stocks in a technical process.

We can overlay computed indicators on our charts such as trendlines, support and resistance lines, moving averages, momentum indicators and more.

Also we can look for patterns of candlesticks that tell us various things about the underlying psychology of the market and help us to determine the probable future price direction. The Trading Game shop has a huge variety of resources you can use to learn how to read charts and put together a trading system. Of course, attending the Trading Game Mentor Program will shortcut this process and help you build a personalised trading system under the expert direction of Chris Tate and Louise Bedford.

The most ignored rule is cutting your losses short.

Share market for beginners

Set a stop loss and stick to it. Your stop loss should be set before you even place you buy order. You can set a stop loss using a variety of methods such as percentage drawdown, pattern recognition or by using a volatility-based stop. Your stop loss acts to keep your loss small if a trade goes against you from the start.

It also helps retain any profits you may have in an existing trade. As the share price rises, move your stop loss point up to position just under the latest share price action and when the trend reverses your stop will be hit and you can exit with the majority of your profits retained. Most private share owners in Australia own shares in just one or two stocks. Putting all your eggs in one basket is never a good idea. You should diversify to a point and spread your capital across a range of stocks from different market sectors.

But not so many that you begin to mirror the performance of the overall market. Spreading your money across too many stocks will also increase the level of brokerage fees you pay and be a nightmare to monitor. When deciding how to use your capital efficiently there are several models from which to choose.

How to invest in the stock market: a beginner's guide | Money Observer

The equal-portions model is where you simply divide your capital into even amounts. This is a simplistic approach in that it assumes that all stocks are created equal. The market capitalisation model compares the size of listed companies based on, you guessed it, their market capitalisation. The All Ordinaries Index, for example, is made up of stocks over a certain market capitalisation.

Many fund managers and institutions also use this factor to determine whether to include stocks in their portfolios. Your trading system outlines the detailed steps you will take to engage the market.

It describes how you will enter a trade, how you will exit and how you will size your positions. We have already looked at stop losses which is your exit methodology. There are other types of signals you could rely on to exit a trade, but the key is, they need to be rule-based. Often they commit too much effort to this task and neglect the importance of having an exit strategy and sizing their positions sensibly.

Looking for an entry signal can be as simple as identifying a share whose price has crossed above a long-term EMA exponential moving average , that has been laid over the weekly share price. Moving to a daily chart you could then look for a technical signal or pattern that indicates a higher probability of the share price moving higher.

To use this method you will also need to determine a stop loss point before placing the trade. The number of shares to buy is Whichever you choose, write it down and use it consistently. What this means is that for a set amount of money, you can take on more risk in exchange for the chance of greater gains.

The simplest form of leverage is Margin Lending. Most people have heard of Margin Lending as it is or used to be aggressively promoted by most of the large broking firms.

The way it works is that a broking firm may have a selection of stocks over which they are comfortable to lend you money. The danger is, of course, leverage is a two-edged sword. Whilst your gains may be multiplied on the upside, you can also suffer magnified losses if the trade goes against you.

Other forms of leverage can be used via CFDs, options and warrants. I encourage you to learn more about these through your own research. There are some great resources for this at the Trading Game online shop. To read more about other instruments that you can use to get more bang for your buck, read these links:.

If you only have a system that takes advantage of an uptrending market, what are you going to do when the market is going sideways or down? Fortunately there are some instruments CFDs, options and warrants and strategies you can use to make money during these times. Instead of buying a stock and then selling it, you sell the stock first and then buy it back at a later time. Your profit is the difference between the sell price and the buy price.

A benefit of short selling is that unlike the options and warrants markets, there is no time decay bought options and warrants decrease in value as they approach their expiration date.

CFDs contracts for difference , options and warrants can be employed via different strategies to make money from an up trending, down trending, or even sideways trending market. Any type of leverage is a dangerous thing in the hands of a novice. In nearly all of the collapses and failures littering the battleground of the GFC in recent years, a common feature is the misuse and lack of respect for the power of leverage. Do not use leverage until you have a track record of unleveraged, successful trading.

New Investor, would you like a margin loan with that? Click here to read more about:.

When you become a trader, your business is to buy, hold and sell stock. There are many different market instruments you can trade such as shares, options, CFDs, forex and commodities. For example, there are specific tax implications associated with whether you define your trading activities as coming under the banner of being an investor or being a trader. Your accountant also needs to have a positive attitude to trading. Do your research and find someone who can help. As traders become more experienced they generally move their focus from the details of what and when to buy to the subject of psychology.

Trading will often make you come face-to-face with your inadequacies. Your flaws will be highlighted and your strengths will be minimised. The aim is to trade in an unemotional manner. Letting your emotions control your trading decisions will have you ignoring your trading rules as set down in your trading plan. Admit when you are wrong about a trade. The market is much bigger than you. Learn from your past mistakes, adjust your plan and continue.

If you are still unsure about what is going on, consult a more experienced trader. There are plenty of books available on trading psychology.

Consistency is the key to long-term success in the markets. Often people have a trading plan that is fundamentally sound but they second guess themselves and deviate away from their rules.

The Trading Game Pty Ltd ACN: This information is correct at the time of publishing and may not be reproduced without formal permission. It is of a general nature and does not take into account your objectives, financial situation or needs. Before acting on any of the information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. The Trading Game Trade Confidently and Safely.

Home About FAQS Shop Privacy Trading Software Broker AFS Licence Website Forum About Louise Bedford About Chris Tate About Scott Lowther About Michael Yardney 7 Reasons to Choose Us Share market for beginners Shares CFDs Options Trading Futures FX Candlestick Charts Trading Psychology Buying Shares in Australia Free Trading Plan Template Rave Reviews More Rave Reviews Even More Rave Reviews Extra Rave Reviews Still More Rave Reviews This is getting ridiculous! Success Stories More Success Stories We Are Traders… A poem to inspire you… Hot Off the Press Reviews You Want Proof?

Register now to get: Please select one ACT NSW NT QLD SA TAS VIC WA Overseas. Return to top of page. Free blog updates from Chris Tate! Join other traders and receive free blog updates direct from Chris Tate.

General Advice Warning The Trading Game Pty Ltd ACN: