A study of impact of crude oil prices on indian stock market

The price of oilor the oil price [1]generally refers to the spot price of a barrel of benchmark crude oil —a reference price for buyers and sellers of crude oil such as West Texas Intermediate WTIBrent ICEDubai CrudeOPEC Reference BasketTapis CrudeBonny LightUrals oilIsthmus and Western Canadian Select WCS. Heavier, sour crude oils lacking in tidewater access—such as Western Canadian Select— are less expensive than lighter, sweeter oil —such as WTI.

Mtechtips Equity & Commodity Advisor-Online Commodity Tips-Stock Market Tips-Accurate Stock Tips-Accurate Commodities Tips-Comex Market

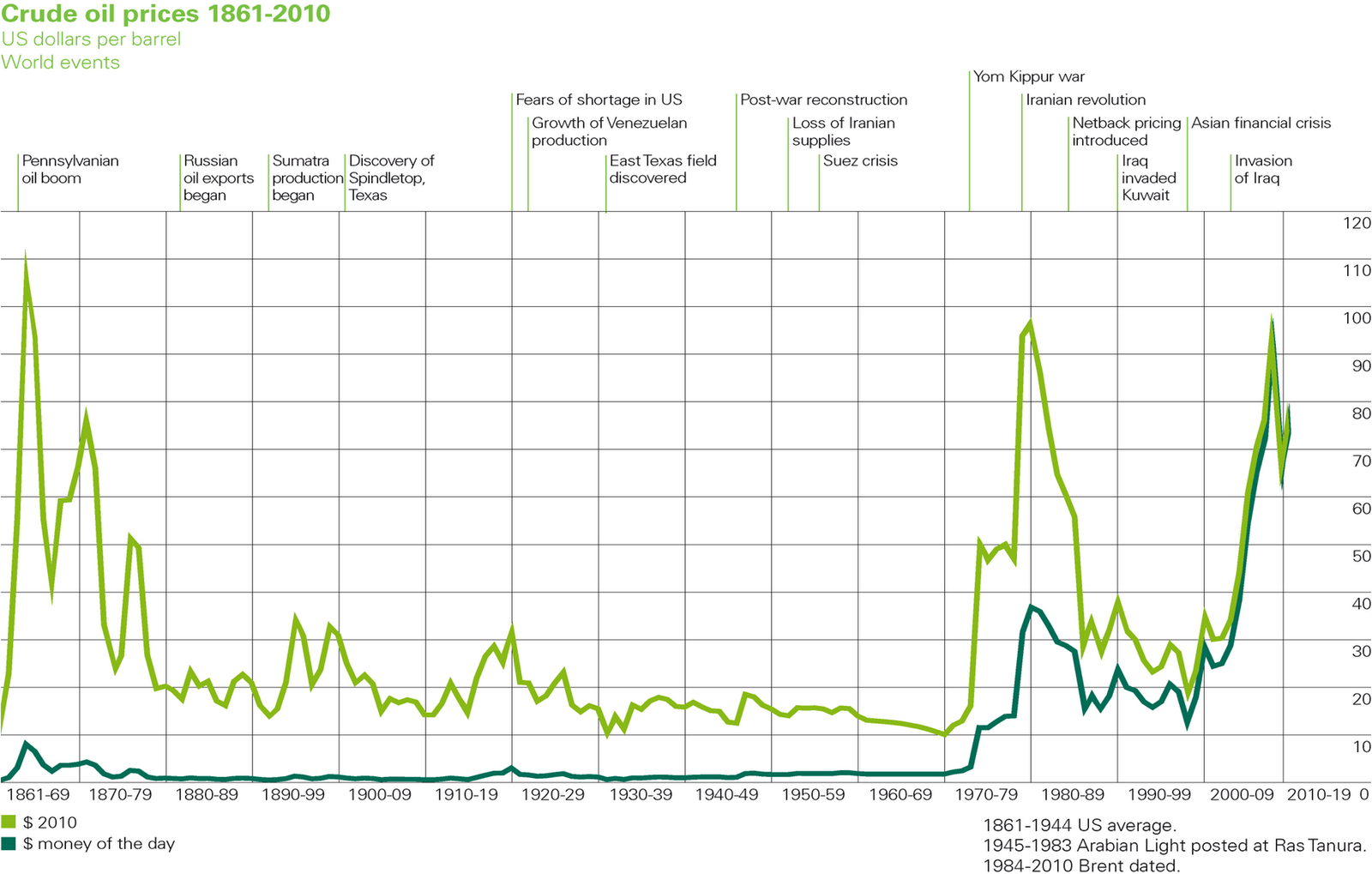

In the Organization of the Petroleum Exporting Countries OPEC was founded in Baghdad, Iraq by its first five members— IranIraqKuwaitSaudi Arabia and Venezuela — [4] [5] [6] to try to counter the oil companies cartelwhich had been controlling posted prices since the so-called Red Line Agreement and Achnacarry Agreementand had achieved a high level of price stability until From til midthe price of oil rose significantly.

It was explained by the rising oil demand in countries like China and India.

India’s World - Impact of falling oil pricesIn the middle ofprice started declining due to a significant increase in oil production in USA, and declining demand in the emerging countries. There are two views dominating the oil market discourse. There are those who strongly believe that the market has undergone structural changes and that low oil prices are here to stay for a prolonged period. At the other end of the spectrum, there are those who think that this is yet another cycle and oil prices will recover sooner rather than later.

These two scenarios — structural versus cyclical — reflect the high degree of uncertainty engulfing the oil market. This presupposes that we can separate neatly the cyclical from the structural, but this would be an oversimplification. All the factors discussed above have become intertwined and the response of one part of the system will affect the other parts.

A survey of the academic literature finds that "most major oil price fluctuations dating back to are largely explained by shifts in the demand for crude oil". Historically, inventory demand has been high in times of geopolitical tension in the Middle East, low spare capacity in oil production, and strong expected global economic growth.

Financial analysts and academics have had very few tools to study such political events compared to what is available on economic aspects of oil price formation. The supply of oil is dependent on geological discovery, the legal and tax framework for oil extraction, the cost of extraction, the availability and cost of technology for extraction, and the political situation in oil-producing countries.

Both domestic political instability in oil producing countries and conflicts with other countries can destabilise the oil price. During the Arab oil embargo of —the first oil shock—the price of oil rapidly rose to double in price. During the Iranian Revolution the price of oil rose. During the s there was a period of "conservation and insulation efforts" and the price of oil dropped slowly to c.

It again reached a peak of c. Following that, there was a period of global recessions and the price of oil hit a low of c. Although the oil price is largely determined by the balance between supply and demand—as with all commodities—some commentators including Business Weekthe Financial Times and the Washington Postargued that the rise in oil prices prior to the financial crisis of — was due to speculation in futures markets.

For a dissenting view of oil prices being determined by demand, see Forbes, "Global Oil Demand is Always Rising - and Not Related to Price". In North America this generally refers to the WTI Cushing Crude Oil Spot Price West Texas Intermediate WTIalso known as Texas Light Sweet, a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange's oil futures contracts.

WTI is a light crude oillighter than Brent Crude oil. It contains about 0. Its properties and production site make it ideal for being refined in the United States, mostly in the Midwest and Gulf Coast regions. WTI has an API gravity of around Cushing, Oklahomaa major oil supply hub connecting oil suppliers to the Gulf Coast, has become the most significant trading hub for crude oil in North America.

In Europe and some other parts of the world, the oil price benchmark is Brent as traded on the Intercontinental Exchange ICE, into which the International Petroleum Exchange has been incorporated for delivery at Sullom Voe.

Other important benchmarks include Dubai, Tapis, and the OPEC basket. The Energy Information Administration EIA uses the imported refiner acquisition cost, the weighted average cost of all oil imported into the US, as its "world oil price".

In Robert Mabro 's book on challenges and opportunities in oil in the 21st century, after the collapse of the OPEC-administered pricing system inand a short lived experiment with netback pricing, oil-exporting countries adopted a market-linked pricing mechanism.

Oil is marketed among other products in commodity markets. By widely traded oil futures, and related natural gas futures, included with most of these oil futures having delivery dates every month: In June Business Week reported that the surge in oil prices prior to had led some commentators to argue that at least some of the rise was due to speculation in the futures markets.

Storing oil is expensive, and all speculators must ultimately, and generally within a few months, sell the oil they purchase. According to a U.

Recent Gas News- Illinois Gas Prices

Commodity Futures Trading Commission CFTC May 29, report the "Multiple Energy Market Initiatives" was launched in partnership with the United Kingdom Financial Services Authority and ICE Futures Europe in order to expand surveillance and information sharing of various futures contracts. Part 1 is "Expanded International Surveillance Information for Crude Oil Trading.

The interim report by the Interagency Task Asia security stock brokers sri lanka, released in July, found that speculation had not caused significant changes in oil prices and that fundamental supply and demand factors provide the best explanation for the crude oil price increases.

The report found that the primary reason for the price increases was that the world economy had expanded at its fastest pace in decades, resulting in substantial increases in the demand for oil, while the oil production grew sluggishly, compounded by production shortfalls in oil-exporting countries. The report stated that as a result of the imbalance and low price elasticityvery large price increases occurred as the market attempted to balance scarce supply against growing demandparticularly in the last three years.

The report forecast that this imbalance would persist in the future, leading to continued upward pressure on oil prices, and that large or rapid movements in oil prices are likely to occur even in the absence of activity by speculators. The task force continues to analyze commodity markets and intends to issue further findings later in the year. The strategy works because oil prices for delivery in the future are trading at a premium a study of impact of crude oil prices on indian stock market those in the spot market - a market structure known in the industry as contango - with investors expecting prices to eventually recover from the near 60 percent slide in oil in the last seven months.

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically-integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the high dividend stocks 2016 australia of oil increases.

Investors replacement stock for winchester model 1300 on the future of oil prices through a financial instrumentoil futures in which they agree on a contract basis, to buy or sell oil at a set date in the future.

Crude oil is stored in salt mines, tanks and oil tankers. Investors can choose to take profits or losses prior to the oil-delivery date arrives. Or they can leave the contract in place and physical oil is "delivered on the set date" to an lost money in stock market tax deduction designated delivery point", in the United States, that is usually CushingOklahoma.

When delivery dates approach, they close out existing contracts and sell new ones for future delivery of the same oil. The oil never moves out of storage. If the forward market is in " contango "—the forward price is higher than the current spot price —the strategy is very successful.

Scandinavian Tank Storage AB and its founder Lars Jacobsson introduced the concept on the market in early By the end of October one in twelve of the largest oil tankers was being used more for temporary storage of oil, rather than transportation.

From June to Januaryas the price of oil dropped 60 percent and the supply of oil remained high, the world's largest traders in crude oil purchased at least 25 million barrels to store in supertankers to make a profit in the future when prices rise.

TrafiguraVitolGunvorKochShell and other major energy companies began to book booking oil storage supertankers for up to 12 months. By 13 January At least 11 Very Large Crude Carriers VLCC and Ultra Large Crude Carriers ULCC " have been reported as booked with storage options, rising from around five vessels at the end of last week. Each VLCC can hold 2 million barrels. In as global capacity for oil storage was out-paced by global oil production, and an oil glut occurred.

Crude oil storage space became a tradable commodity with CME Group — which owns NYMEX — offering oil-storage futures contracts in March By 5 Marchas oil production outpaces oil demand by 1. Crude oil is stored in old salt mines, in tanks and on tankers. Peak oil is the period when the maximum rate of global petroleum extraction is reached, after which the rate of production enters terminal decline.

It relates to a long-term decline in the available supply of petroleum. This, combined with increasing demand, will significantly increase the worldwide prices of petroleum derived products. Most significant will be the availability and price of liquid fuel for transportation. The US Department of Energy in the Hirsch report indicates that "The problems associated with world oil production peaking will not be temporary, and past "energy crisis" experience will provide relatively little guidance.

A major rise or decline in oil price can have both economic and political impacts. The decline on oil price during — is considered to have contributed to the fall of the Soviet Union. The reduction in food prices that follows lower oil prices could have positive impacts on violence globally.

Research shows that declining oil prices make oil-rich states less bellicose. Lower starc bands vs bollinger bands prices lead to greater global trade.

Declining oil prices may boost consumer oriented stocks but may hurt oil-based stocks. The oil importing countries like Japan, China or India would benefit, however the oil producing countries would lose. It shows the GDP increase between 0.

Katina Stefanova has argued that falling oil prices do not imply a recession and a decline in stock prices. Economists have observed that the oil glut also known as s oil glut started with a considerable time-lag, more than six years after the beginning of the Great Recession: But nothing guarantee[d] such price levels in perpetuity ". During —, OPEC members consistently exceeded their production ceiling, and China experienced a marked slowdown in economic growth.

At the same time, U. A combination of factors how to make money on blogher a plunge in U.

It has also been argued that the collapse in oil prices in should be very beneficial for developed western economies, who are generally oil importers and aren't over exposed to declining demand from China. The most vulnerable economies were those with a high dependence on fuel and mineral exports to China, such as: On the other hand, lower commodity prices led to an improvement in the trade balance — through lower the cost of raw materials and fuels — across commodity importing economies, particularly Cambodia, Kyrgyzstan, Nepal and other remote island nations Kiribati, Maldives, Micronesia F.

SSamoa, Tonga, and Tuvalu which are highly dependent on fuel and agricultural imports [69]. The North Sea oil and gas industry was financially stressed by the reduced oil prices, and called for government support in May The use of hedging using commodity derivatives as a risk management tool on price exposure to liquidity and earnings, has been long established in North America. Chief Financial Officers CFOS use derivatives to dampen, remove or mitigate price uncertainty.

With the large number of bankruptcies as reported by Deloitte [19] "funding [for upstream oil industry] is shrinking and hedges are unwinding. To finance exploration and production of the unconventional shale oil industry in the United States, "hundreds of billions of dollars of capital came from non-bank participants [non-bank buyers of bank energy credits] in leveraged loans] that were thought at the time to be low risk.

A classic example of taking on too much risk through hedging is the collapse of Penn Square Bank caused by plummeting of the price of oil in Penn Square Bank caused the failure of Seafirst in and then Continental Illinois.

At the 5th annual World Pensions Forum inJeffrey Sachs advised institutional investors to divest from carbon-reliant oil industry firms in their pension fund 's portfolio.

Impact of Crude Oil Prices on the Bombay Stock Exchange | Open Access Journals

From Wikipedia, the free encyclopedia. Redirected from Oil prices. This article is about the price of crude oil. For information about derivative motor fuels, see gasoline and diesel usage and pricing. For detailed history of price movements sincesee World oil market chronology from World oil market chronology from Oil depletion and Peak oil. Retrieved February 17, Retrieved 16 February The Epic Quest for Oil, Money, and Power.

The Journal of American History. Retrieved 17 February Retrieved January 5, Retrieved 5 January Retrieved 29 December Structural, Cyclical or Both?

Oxford Institute for Energy Studies. Why the Price of Oil May Still Surprise Us". The Journal of Economic Perspectives. Archived from the original on June 1, Archived from the original on Oil in the 21st century: Organization of Petroleum Exporting Countries.

Retrieved June 11, After Sitting on Crude, speculators Unload It. The World's Eyes Fall on Cushing, Oklahoma". Retrieved 20 January Grain and Oil, By Yegor Gaidar, American Enterprise Institute, " PDF. Retrieved 17 October British Journal of Political Science.

The Ambiguous Effects of Oil Wealth and Oil Dependence on Violent Conflict". Journal of Peace Research. American Political Science Review. Conflict Management and Peace Science: Oxford Centre for the Analysis of Resource Rich Economies, University of Oxford. A Regional Tour - The Financialist". Are Plunging Oil Prices a Positive or a Negative? Country Risk Implications of the Saudi-Qatari Rift".

InPlay from lazuxyderonav.web.fc2.com

The New York Times. Retrieved December 13, Retrieved 21 January Risks to Exports and Economic Growth in Asia-Pacific LDCs and LLDCs". Oil and Gas Financial Journal. Fund Managers Have a Duty to Dump Fossil Fuels". Retrieved 30 December Argus Sour Bonny Light Brent Dubai Indonesian Isthmus Light Japan Cocktail OPEC Reference Basket Tapis Urals Western Canadian Select West Texas Intermediate. Consumption Production Reserves Imports Exports Price. Petroleum fiscal regime Concessions Production sharing agreements Artificial lift Pumpjack Submersible pump ESP Gas lift Downstream Enhanced oil recovery EOR Steam injection Gas reinjection Midstream Petroleum product Pipeline transport Refining Upstream Water injection Well intervention XT.

List of natural gas fields List of oil fields East Midlands Oil Province East Texas Gulf of Mexico Niger Delta North Sea Permian Basin Persian Gulf Prudhoe Bay Oil Field Russia Venezuela Western Canadian Sedimentary Basin.

Acronyms Oil shale gas Peak oil mitigation timing People Petrocurrency Petrodollar recycling Shale gas Swing producer Unconventional oil heavy crude oil sands oil shale.

BP Chevron Eni ExxonMobil Royal Dutch Shell Total. ADNOC UAE CNOOC China CNPC China Ecopetrol Colombia Gazprom Russia Iraq National Oil Company Indian Oil Corporation KazMunayGas Kazakhstan Kuwait Petroleum Corporation Lotos Poland Nigerian National Petroleum Corporation NIOC Iran NISOC Iran OGDCL Pakistan ONGC India PDVSA Venezuela PKN Orlen Poland Pemex Mexico Pertamina Indonesia PetroBangla Bangladesh Petrobras Brazil PetroChina Petronas Malaysia Petrovietnam PTT Thailand Qatar Petroleum Rosneft Russia Saudi Aramco Saudi Arabia Sinopec China SOCAR Azerbaijan Sonangol Angola Sonatrach Algeria Statoil Norway TPAO Turkey YPF Argentina.

Glencore Gunvor Mercuria Naftiran Intertrade Trafigura Vitol. Retrieved from " https: Petroleum economics Commodity markets Pricing Modern economic history. Pages using web citations with no URL Pages using citations with accessdate and no URL Use mdy dates from February Navigation menu Personal tools Not logged in Talk Contributions Create account Log in.

Views Read Edit View history. Navigation Main page Contents Featured content Current events Random article Donate to Wikipedia Wikipedia store. Interaction Help About Wikipedia Community portal Recent changes Contact page. Tools What links here Related changes Upload file Special pages Permanent link Page information Wikidata item Cite this page. In other projects Wikimedia Commons. This page was last edited on 16 Juneat Text is available under the Creative Commons Attribution-ShareAlike License ; additional terms may apply.

By using this site, you agree to the Terms of Use and Privacy Policy. Privacy policy About Wikipedia Disclaimers Contact Wikipedia Developers Cookie statement Mobile view. Wikimedia Commons has media related to Oil prices. Benchmarks Argus Sour Bonny Light Brent Dubai Indonesian Isthmus Light Japan Cocktail OPEC Reference Basket Tapis Urals Western Canadian Select West Texas Intermediate.

Natural gas Consumption Production Reserves Imports Exports Price. Companies and organisations Major petroleum companies Supermajors BP Chevron Eni ExxonMobil Royal Dutch Shell Total.