Efficient market hypothesis and stock prices

Join the NASDAQ Community today and get free, instant access to portfolios, stock ratings, real-time alerts, and more! Over the past 50 years, efficient market hypothesis EMH has been the subject of rigorous academic research and intense debate. It has preceded finance and economics as the fundamental theory explaining movements in asset prices. The accepted view is that markets operate efficiently and stock prices instantly reflect all available information.

Since all participants are privy to the same information, price fluctuations are unpredictable and respond immediately to genuinely new information. As a result, efficient markets do not allow investors to earn above average returns without accepting additional risks. Yet, as we all know or have experienced ourselves, markets do not always act this way or exhibit rationality. In fact, a fundamental shortcoming of EMH is its inability to explain excess volatility.

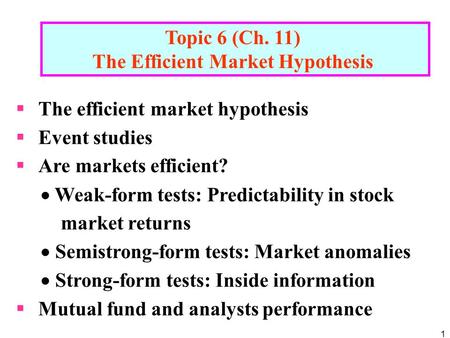

Fundamental to modern portfolio theory, efficient markets are the basis that underpins financial decision making. The logic behind this is characterized by a random walk, where all subsequent price changes reflect a random departure from previous prices. In this case, news and price changes are unpredictable. Therefore, both a novice and expert investor, holding a diversified portfolio, will obtain comparable returns regardless of their varying levels of expertise. As we know, the distribution of news is channeled through various sources and according to Fama, this represents three different forms of market efficiency; strong form, semi-strong form, and weak form.

Strong form efficiency is where all information, public, personal and confidential, is reflected in share prices. Therefore investors are unable to achieve a competitive advantage and deters insider trading. To a lesser degree, semi-strong efficiency proposes that share prices are a reflection of publicly available information.

Since market prices already reflect public information, investors are unable to gain abnormal returns. Therefore, technical analysis is not a practical tool to predict future price movements.

While efficient market theory resonates throughout financial research, it has often fallen short in its application throughout history.

What is the Efficient Market Hypothesis? -- The Motley Fool

In the wake of the Financial Crisis, many of our traditional financial theories have been challenged for their lack of practical perspective on the markets. If all the assumptions about efficient markets had held, then the housing bubble and subsequent crash would not have occurred. Yet, efficiency failed to explain market anomalies, including speculative bubbles and excess volatility.

As the housing bubble reached its peak and investors continued to pour funds into subprime mortgages, irrational behavior began to precede the markets.

Contrary to rational expectations, investors acted irrationally in favor of potential arbitrage opportunities. Yet an efficient market would have automatically adjusted asset prices to rational levels. Besides its failure to address financial downturns, the theory itself has often been contested. In theory, each individual is able to access and analyze information at the same pace.

However, with the growing number of information channels, including social media and the internet, even the most involved investors are unable to monitor every piece of information. With that being said, investment decisions tend to be influenced more efficient market hypothesis and stock prices by emotions rather than rationality.

Like any new study, behavioral finance began from the anomalies that the prevailing wisdom, efficient markets, could not explain. As a budding field, behavioral finance seeks to incorporate cognitive psychology with conventional finance in order to provide an explanation for irrational investment decisions. At its core, behavioral finance is based on the notion that investors are subject to behavioral biases which influence less than rational decisions.

Often times, behavioral based biases come from cognitive psychology and have been applied to financial markets.

Investing Basics: What Is The Efficient Market Hypothesis, and What Are Its Shortcomings? - lazuxyderonav.web.fc2.com

While these are some of the most frequently exhibited phenomena, many other biases present themselves in our decision making. With this in mind, markets forex ekonomikos naujienos do not price assets as rationally as an efficient market would claim.

Therefore, constructing a portfolio with a behavioral approach should incorporate multiple layers make money playing madden each layer representing a well-defined goal.

The base layer, for example, should intend to hold low risk assets as a means to mitigate risk and losses, while a higher level would attempt to maximize returns. Many concepts of behavioral finance tend to contradict the efficient market hypothesis and stock prices of efficient markets.

Efficient Market Hypothesis

With that being said efficiency should not be discounted altogether. Your future research and decisions should approach the market from an eclectic standpoint. Understanding the strengths and weaknesses of multiple theories may not make you the next Warren Buffet, but can significantly help you comprehend forex kosovo information and make more informed investment decisions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc. Enter up to 25 symbols separated by commas or spaces in trading weekly options text box below.

These symbols will be available during your session for use on applicable pages. You have selected to change your default setting for the Quote Search.

This will now be your default target page; unless you change your configuration again, or you delete your cookies. Are you sure you want to change your settings?

Please disable your ad blocker or update your settings to ensure that javascript and cookies are enabledso that we can continue to provide you with the first-rate market news and data you've come to expect from us. Company News Market Headlines Market Stream. Economic Calendar Business Video Technology News.

How to Invest Investing Basics Broker Comparison Glossary Stocks Mutual Funds. ETFs Forex Forex Broker Comparison. Wealth Management Options Bonds. Retirement Real Estate Banking Insurance.

Saving Money Taxes Investments Small Business. Stock Ratings My Ratings Smart Portfolio Overview My Holdings My Portfolio Analysis Crowd Insights My Performance Customize Your Experience. Join Today Already a member? What Is The Efficient Market Hypothesis, and What Are Its Shortcomings?

October 15, Efficient Markets Fundamental to modern portfolio theory, efficient markets are the basis that underpins financial decision making. This article appears in: InvestingInvesting BasicsInvesting IdeasStocks.

Efficient Market Hypothesis

More from Trevir Nath. Follow Trevir on Twitter. Related Investing Basics Articles. Most Popular Highest Rated. AMZN Is Up Sharply After Whole Foods Acquisition Snap's share price sinks, trades just above IPO price. View All Highest Rated.

Research Brokers before you trade.

Visit our Forex Broker Center. Find a Credit Card Select a credit card product by: Bad Credit Credit Quality Average Credit Quality Excellent Credit Quality Fair Credit Quality Good Limited or No Credit History Personal Loans. American Express American Express Airline Cards American Express Business Cards American Express Cash Back Credit Cards American Express Charge Cards Barclaycard Capital One Capital One Cash Back Capital One Fair Credit Capital One Miles Capital One Points Capital One Prepaid Credit Cards Chase Citi Credit Cards Discover Discover Cashback Discover Miles Discover Student Credit Cards MasterCard Credit Cards U.

Bank USAA USAA Savings Visa Credit Cards. CLOSE X Edit Favorites Enter up to 25 symbols separated by commas or spaces in the text box below. CLOSE X Customize your NASDAQ. CLOSE X Please confirm your selection: Why Alphabet's Waymo Is Leading in Self-Driving Cars Alphabet began its self-driving experiment as early as Update Clear List CLOSE X Customize your NASDAQ. If, at any time, you are interested in reverting to our default settings, please select Default Setting above. If you have any questions or encounter any issues in changing your default settings, please email isfeedback nasdaq.

7. Efficient Markets