Effect of hyperinflation on stock market

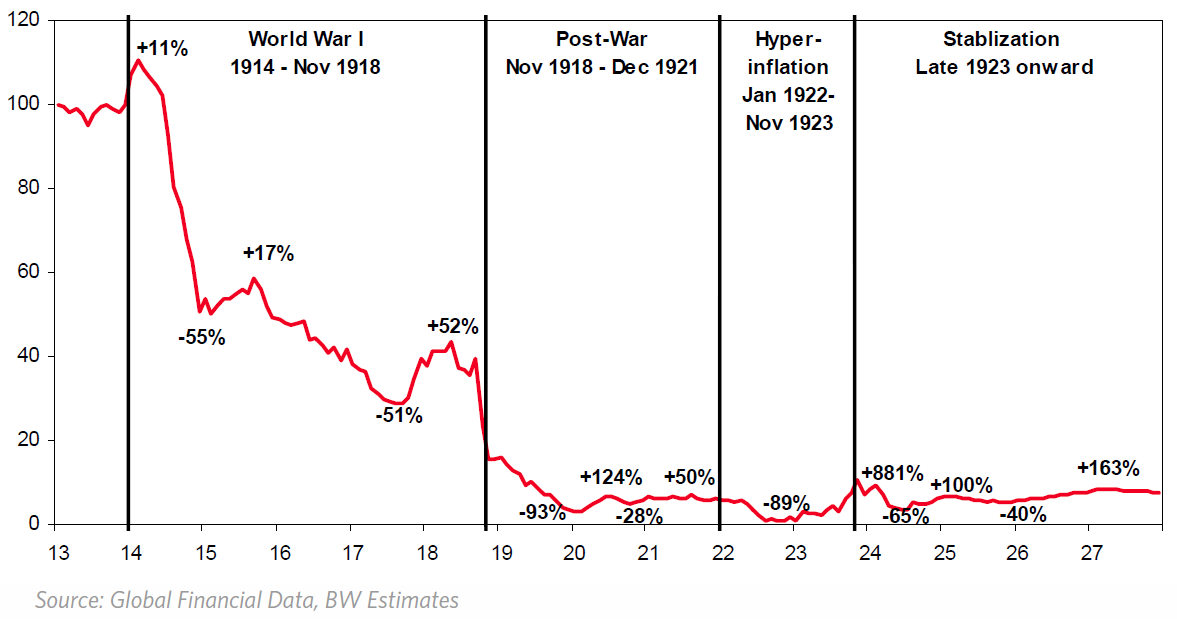

Periods of inflation such as what took place in the U. Hyperinflation is even worse, due to the extreme rise in prices that accompanies it. The most notorious time of hyperinflation was in Germany right after World War 2, when it reportedly took a literal wheelbarrow full of paper money to buy a loaf of bread. During hyperinflation, stock prices will rise just like other prices.

What Effect Will Hyperinflation Have? | Seeking Alpha

Hyperinflation is an economic condition resulting in the increase in prices at an extremely high rate. In a hyperinflation situation, prices can increase as much as 50 percent per month, perhaps even more.

This situation is often caused by a near total collapse in a country's economic system, causing its currency to become nearly worthless. It is often caused by excessive deficit spending by a government, which then results in the government printing more money to fund its spending, significantly decreasing the value of that money. Stock prices will be affected in times of hyperinflation, driven by the overall increase in prices of all other goods and services.

These increases in pricing would cause sales and profits to increase, which could also increase dividends paid by companies, as well as increasing the prices that stocks sell for, sometimes significantly.

Hyperinflation causes prices to rise dramatically, and although it is followed usually by wages rising as well, wages may not rise as quickly as prices, and it can lead to some people having significant problems paying for necessary goods and services. In addition, people who have cash in savings accounts or certificates of deposit will see that cash devalued quickly. The problems that people have making purchases due to hyperinflation can cause companies to have financial problems due to weak economic conditions and may also cause these companies to go out of business.

Real estate is traditionally a good investment in times of high inflation, particularly if you have a fixed-rate mortgage. The reason for this is because you are paying back the mortgage with money that is reduced in value due to inflation.

Stocks can work well in a hyper-inflationary economy, but generally only if your portfolio is well diversified with many stocks and you hold on to the investments over the longer term. Craig Woodman began writing professionally in Woodman's articles have been published in "Professional Distributor" magazine and in various online publications. He has written extensively on automotive issues, business, personal finance and recreational vehicles.

Woodman is pursuing a Bachelor of Science in finance through online education. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Visit performance for information about the performance numbers displayed above.

Skip to main content. What Is Pushing a Bond Yield Higher?

How Are the Prices of Stock Set on the NYSE? Do Bond Funds Lose Money When Interest Rates Go Up? Background Hyperinflation is an economic condition resulting in the increase in prices at an extremely high rate. Increasing Stock Prices Stock prices will be affected in times of hyperinflation, driven by the overall increase in prices of all other goods and services. Overall Economic Effects Hyperinflation causes prices to rise dramatically, and although it is followed usually by wages rising as well, wages may not rise as quickly as prices, and it can lead to some people having significant problems paying for necessary goods and services.

Protections Against Hyperinflation Real estate is traditionally a good investment in times of high inflation, particularly if you have a fixed-rate mortgage. Winners and Losers if Inflation Skyrockets Kiplinger: How to Protect Your Portfolio From Inflation Market Watch: German Inflation Obsession Will Keep Euro Strong Business Dictionary.

About the Author Craig Woodman began writing professionally in Recommended Articles How Does Inflation Affect the Standard of Living? How to Figure How Much Equity I Have in My House What Determines the Bond's Market Price?

Do Utilities Stocks Perform Well During Inflationary Periods? Related Articles What Is a Stock Market Correction? How Do I Get a Stock Beta Value? Gold Investment How Do Dividends Affect Stock Price?

How Volume Affects & Plays a Role in Stock PricesWhat Does a Point on the Stock Exchange Mean? Money Sense E-newsletter Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

Editor's Picks How to Set Up a Scanner for Penny Stocks Correlation of Treasuries With Stocks Do Fluctuations in Wine Stocks Affect Wine Prices?

Three Factors That Affect the Market Value of a Stock How Speculation Raises Shares. Trending Topics Latest Most Popular More Commentary. Quick Links Services Account Types Premium Services Zacks Rank Research Personal Finance Commentary Education.

Resources Help About Zacks Disclosure Privacy Policy Performance Site Map.

Inflation: Effects On Stock Prices | Seeking Alpha

Client Support Contact Us Share Feedback Media Careers Affiliate Advertise. Follow Us Facebook Twitter Linkedin RSS You Tube. Zacks Research is Reported On: Logos for Yahoo, MSN, MarketWatch, Nasdaq, Forbes, Investors. Logo BBB Better Business Bureau.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.