Review of the foreign exchange market structure

The rationale behind this post is to break down the inner workings of the foreign exchange market and perhaps provide some enlightenment on the current situation, the forex market in general, the reason why we have and need forex brokers, and how forex brokers make their profit.

More importantly, it aims to provide some understanding as to why we, as forex speculators, can and should, despite a very volatile market, continue to trade. While speculation plays a smaller, but nonetheless important role, the vast majority of forex trades are primarily made as a means to facilitate international business transactions. An example might help to shed a little light on this. Somewhere along the line, the U.

Dollar money from the car purchase has to be converted to Japanese Yen to pay those workers. If you think about it, huge multi-nationals like Nestle, Exxon-Mobil, Microsoft, Honda, Sony, G-E and tens of thousands of other smaller global entities move nearly every single U. Decades ago, it was a matter of a simple telephone call from a banker in one country to another banker in a different country.

Banks that had an international presence could merely do a branch to branch transfer. Remember, banks are in the business to make money, just like any other business.

So when a bank bought foreign currency at one price, they naturally added their margin to it before selling it to another customer. That margin is called the spread.

For all intents and purposes, that was, and remains, a fairly reasonable cost. From our earlier example, Mitsubishi gets Japanese Yen in payment for the Eclipse, and is now able to pay its workers who built the car.

The car owner is happy, Mitsubishi is happy and the Mitsubishi factor workers are happy. The banks which facilitated the foreign exchange transaction are also happy, because they earned a tidy little profit the spread for handling the transaction, and for accepting the associated risks inherent with foreign exchange. One of the consequences of transacting all this foreign exchange business is that bank traders soon developed an ability to speculate as to the direction of future currency rates.

With a better grasp of how the market works, a bank could give a customer a quote adding a spread to the current rate but actually hold off or hedge until a better rate comes along. In so doing, the banks were able to dramatically increase their net income. One unfortunate end result, though, was that the method of redistributing the liquidity made it impossible to complete certain forex transactions. For that reason alone, the foreign exchange market needed to be made available to non-bank participants.

Naturally, the banks wanted to be able to execute more orders in the forex market which would allow them to profit from less experienced participants who provided a better distribution of the liquidity and which permitted them to execute their hedge orders from their international customers.

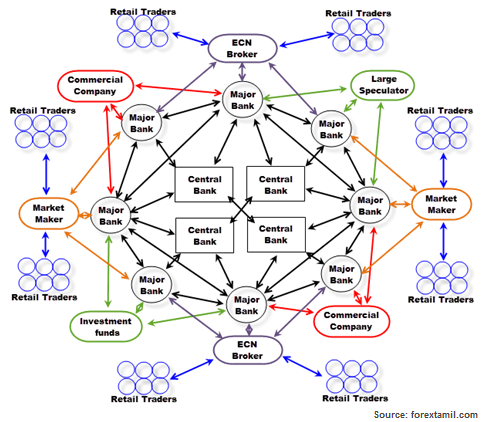

At the very top of the forex market are transactions which are collectively called Interbank transactions. Rather, it is a collection or compilation of agreements between and among the major money center banks in the world. In most larger offices or business, perhaps even in your own home, there may be several computers which are inter-connected by means of a simple network cable.

Now, each computer operates independently until the moment it needs a resource, program or file from one of the other computers. When that happens, computer A will contact computer B or C or D, etc. If the owner or operator of Computer B authorizes it, and if Computer B is functioning the way it should be, then the needed file or program can be accessed. It works the same way in the forex market; just substitute Computer A and Computer B for Bank A and Bank B and let resources substitute for currency.

You now have the machinations for the relationships that exist within the Interbank system. Regarding prices and forex currency inventory, the same issue exists within the Interbank market system. If a bank in Taiwan occasionally transacts business with a firm in Sao Paula they need to exchange their currency.

In this case, it can be quite difficult to determine what the proper exchange rate between the New Taiwan Dollar and the Brazilian Real should be.

Because of situations such as this, the Electronic Broking Service EBS and Reuters established their services. In a way, the EBS service acts as a blanket over the Interbank communication links. Through the EBS service, Interbank members are able to see how much currency is available, and the price s the other Interbank participants are willing to pay. The EBS system is merely an application allowing bank members to see offers and bids from the other members.

If you were to call your local Citibank branch, they can arrange for you to exchange your U. Dollar for the foreign currency of your choosing. In all probability, they will likely just move the desired currency from one bank branch to another one. Anyone who trades in the forex market should consider paying their bank a visit, at least once, to have an idea of their quotes. The third tier is the retail market.

Established foreign exchange brokers such as Forex.

Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity in Canada during April - Bank of Canada

The large majority of these forex brokers sign an agreement with a single bank. This bank agrees to provide liquidity only under certain conditions: That is only if they can simultaneously hedge it on EBS, including their desired spread.

These spreads will be highly competitive, and that is because that volume will be much greater than any single bank patron would ever transact. Bear in mind, banks are in the business to make money, and third tier providers will almost never precisely match what actually exists on the Interbank system. Banks collect the spreads and no agreement between them and a forex retailer is going to alter their priority.

Think of retail forex as a kind of casino. The forex broker has the house advantage because of the inherent spread system and the normal probability distribution of returns. What results, is a system that plays one loser against one winner and collects the spread. If there is a dis-equilibrium within their internal order book, a broker may hedge the exposure with their second tier liquidity provider.

Forex Market Structure - lazuxyderonav.web.fc2.com

Though it may not sound good, there are significant advantages to the speculators that work with them. An ECN or Electronic Communications Network operates similarly to a second tier bank, but it exists, rather, on the third tier. The ECN generally will establish a liquidity agreement with more than one second tier bank. Instead of internally matching the book orders, it just passes the quotes through from the banks, as they are, to be traded.

You might look at it as an EBS, of sorts, intended for the little guys. Depending on the bank and market conditions, this may take the structure of price shading or wider spreads. For its efforts, the ECN collects a commission for each transaction.

Beside the commission factor, other disadvantages need to be considered by a speculator before using an ECN. For example, most offer significantly less leverage and only permit full lot transactions. Under specific market conditions, a bank may pull out their liquidity, which will leave traders without the opportunity to get into our out of positions at a chosen price.

If an order is too big to handle at the current price, then the price has to move to a point where there is enough open interest to cover the transaction. Prices can move in no other way. As we discussed previously, each bank lists on the Electronic Broking Service how much and at which price the bank is willing to transact in a given currency. You may notice that there is generally open interest of different sizes at different prices. Knowing this information, say a market sell order is placed for Provided there were no additional orders, the spread would continue to remain that large.

Fortunately, at some point in time, someone somewhere will look at a price point somewhere between those two figures as an ideal opportunity and place an order.

Introduction to the Foreign Exchange Market | DailyForex

You may wonder what might have happened if a sell order for 2 million is placed, just a split second after the That order would be filled at 1. The more interesting question would be what if all of the listed orders were canceled suddenly?

In that case, the spread would increase to the point at which there would exist bids and offers. Now, that might be 5, 8,10 or even, say, pips. It will widen to whatever is the difference between the bid price and the offer price. Regardless which market is under examination, or what broker is attempting to facilitate a transaction, it is nearly impossible to avoid both spreads and slippage. In the trading world, they are simply a fact of life.

Trading has often been justifiably described as a zero sum kind of game. If Trader Alpha sells a commodity or security to Trader Beta and the price of it goes up, then Trader Alpha just lost money on the transaction.

Even in an enormous market such as the Forex market, each transaction must have both a buyer and seller, and, without fail, one of the participants will lose money. Generally, this is essentially irrelevant to the participants within the general realm of forex trading. But there may arise certain situations where it does become significantly important, and one such situation is a media event. Of late, there has been a great deal of talk about how, during some spectacular news event, it is or should be illegal, immoral or in some cases, just plain evil for a broker or a bank or some other liquidity provider to cancel or withdraw their order which increases the spread or for a slip order to be executed as though that was really what they wanted in the first place more then normal.

Cancellations and slip orders occur for specific reasons that have absolutely nothing to do with anyone trying to screw everyone else. Leading up to the release of an economic report, certain traders will generally enter into a position one way or another in anticipation of the news.

As it becomes imminent, banks on the Interbank market will pull or remove their speculative orders in fear of significant losses. Technical traders will also pull their orders, as it is a common practice that they avoid the news altogether.

Where, then, is the liquidity, which is necessary to preserve a tight spread going to come from? Moving down to the second tier, a bank is only willing to provide liquidity to a retail broker or an ECN if they can immediately hedge the positions on Interbank with, of course, the requisite spread. The retailer that guarantees spreads of between 2 and 5 pips just created a huge hole in his risk profile as he can no longer hedge his net exposure. How many traders are going into this with positions wrongly chosen, who will need to get out of that position ASAP?

How many macro traders or hedge funds will instantaneously drop their macro orders? What numbers of them will be waiting to hear about a miss and execute their market orders?

And with the technical traders sitting out on the sidelines, who in their right mind is going to be so foolish as to take the other position on all of these orders?

The simple answer is no one will be that foolish. Within 5 seconds of the news hitting, it is a just a single direction market, one way or the other. And that long pin bar which you see graphed is the grand total of two prices -- the one just before the announcement and the one right afterward. However many pips are between them is the gap. It should come as no surprise that slippage occurs at this point in time. Each and every tier of the foreign exchange market has distinct advantages and disadvantages.

Depending upon your priorities, you need to choose between the restrictions and limitations you can accept and those you cannot. It should go without saying, but you cannot always get everything that you want.

If a forex trader really wants to take profitability to the next level, they should spend their time focusing on how best to identify these positions, and trade with an objective to capturing the price movement which they will, inevitably, cause.

By accepting a forex broker for what he is, and what he can offer, learning how to work with him, given the limitations of their relationship, traders will have access to a wealth of opportunity that they could never otherwise envision. Registration is required to ensure the security of our users.

Login via Facebook to share your comment with your friends, or register for DailyForex to post comments quickly and safely whenever you have something to say. Log in Create a DailyForex. Want to get in-depth lessons and instructional videos from Forex trading experts? Register for free at FX Academy, the first online interactive trading academy that offers courses on Technical Analysis, Trading Basics, Risk Management and more prepared exclusively by professional Forex traders.

DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals and Forex broker reviews. The data contained in this website is not necessarily real-time nor accurate, and analyses are the opinions of the author and do not represent the recommendations of DailyForex or its employees.

Currency trading on margin involves high risk, and is not suitable for all investors.

As a leveraged product losses are able to exceed initial deposits and capital is at risk. Before deciding to trade Forex or any other financial instrument you should carefully consider your investment objectives, level of experience, and risk appetite.

We work hard to offer you valuable information about all of the brokers that we review. In order to provide you with this free service we receive advertising fees from brokers, including some of those listed within our rankings and on this page. While we do our utmost to ensure that all our data is up-to-date, we encourage you to verify our information with the broker directly. Forex Reviews Forex Brokers Reviews Bitcoin Forex Brokers ECN Forex Brokers US Forex Brokers UK Forex Brokers Canadian Forex Brokers Australian Forex Brokers Singapore Forex Brokers South Africa Forex Brokers Islamic Forex Brokers Regulated Forex Brokers MT4 Forex Brokers Mobile Trading Brokers Social Trading Platforms.

Oil Trading Brokers Gold Trading Brokers NFA Regulated Brokers Automated Forex Trading More In Reviews Forex Brokers By Type Forex Signals Reviews Forex Products Reviews Forex Courses Reviews Forex Brokers Bonuses Binary Options Brokers Full Brokers List. Forex News Technical Analysis Fundamental Analysis Trading Mind Blog Forex Blog Financial Humor Forex Expo Forex Newsletter More Technical Analysis Weekly Forex Forecast Free Forex Signals Gold Price Forecast.

Analysis By Pair EUR-USD USD-JPY GBP-USD USD-CHF USD-CAD AUD-USD Bitcoin-USD Gold Oil. How To Choose a Broker Guide Learn Forex at FXAcademy Forex Articles Binary Options Trading Forex Social Trading Guide Forex Glossary Forex Basics Forex Webinars Forex Regulations. DailyForex Mobile App Need Help Choosing a Broker?

Report Broker Scams Forex Widgets Sitemaps. Forex Articles Introduction to the Foreign Exchange Market Introduction to the Foreign Exchange Market. Speculator Implications Trading has often been justifiably described as a zero sum kind of game. Conclusions Each and every tier of the foreign exchange market has distinct advantages and disadvantages.

Sign Up Read Review. Free Forex Trading Courses Want to get in-depth lessons and instructional videos from Forex trading experts?

Exchange Rate Arrangements and Currency Convertibility: Developments and Issues - R. B. Johnston - Google Livres

Sign up to get the latest market updates and free signals directly to your inbox. Most Visited Forex Broker Reviews. About Us Contact Us. Enter your email address here: