Describe what happens to the money supply when a commercial bank makes a loan

Log in Sign up. How can we help? What is your email? Upgrade to remove ads.

Cite two significant characteristics of the fractional reserve banking system today. Today gold is not used as reserves 2 Lending policies must be prudent to prevent bank "panics" or "runs" by depositors worried about their funds.

Macro Notes 2: The Money Supply

Also, the US deposit insurance system prevents panics. Define the basic items in a bank's balance sheet.

A balance sheet states the assets and claims of a bank at some point in time. Describe what happens to a bank's balance sheet when the bank is created, it buys property and equipment, and it accepts deposits.

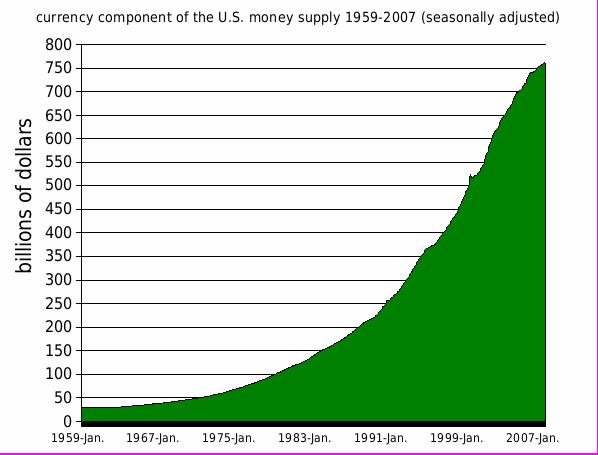

Explain the effects of the deposit of currency in a checking account on the composition and size of the money supply. Banks bust keep reserve deposits in its district Federal Reserve Bank -banks can keep reserves at Fed or in cash in vaults -banks keep cash on hand to meet depositors -required reserves are a fraction of deposits.

Recount the story of how goldsmiths came to issue paper money and became bankers who created money and held fractional reserves.

They issued receipts for these deposits -Receipts came to be used as money in place of gold -Goldsmiths realized they could "loan" gold by issuing receipts to borrowers, who agreed to pay back gold plus interest -Such loans began "fractional reserve banking" because the actual gold in the vaults became only a fraction of the receipts held by borrowers and owners of gold.

Define the reserve ratio. Compute a bank's required and excess reserves when you are given the needed balance-sheet figures. Explain why a commercial bank is required to maintain a reserve and why a required reserve is not sufficient to protect the depositors from losses.

Glossary - Aviva plc

Required reserves do not exist to protect against "runs", because banks must keep their required reserves. Indicate whether required reserves are assets or liabilities for commercial banks and the Federal Reserve. Reserves are an asset to banks but a liability to the Federal Reserve Bank system, since now they are deposit claims by banks at the Fed. Describe how the deposit of a check drawn on one commercial bank and deposited into another will affect the reserves and excess reserves of the two banks.

The writing of a check on the bank and its deposit in a second bank results in a loss of reserves assets and checkable deposits liabilities for the first bank, and a gain in reserves and deposits for the second bank. Show what happens to the money supply when a commercial bank makes a loan. Show what happens to the money supply when a commercial bank buys government securities. Describe what would happen to a commercial bank's reserves if it made loans or bought government securities in an amount greater than its excess reserves.

State the money-creating potential of a commercial bank the amount of money a commercial bank can safely create by lending or buying securities. Legally, a bank can lend only to the extent of its excess reserves Likewise, when banks or the Federal Reserve sell government securities to the public, they decrease supply of money like a loan repayment does.

Income Tax

Explain how a commercial bank's balance sheet reflects the banker's pursuit of the two conflicting goals of profit and liquidity. They earn profits primarily from interest on loans and securities the hold -Liquidity: Explain how the Federal funds market helps reconcile the goals of profits and liquidity for commercial banks. Banks can borrow from one another to meet cash needs in the federal funds market, where banks borrow from each other's available reserves on an overnight basis.

The rate paid is called the federal funds rate.

State the money-creating potential of the banking system. The entire banking system can create an amount of money which is a multiple of the system's excess reserves, even though each bank in the system can only lend dollar for dollar with its excess reserves. Explain how it is possible for the banking system to create an amount of money that is a multiple of its excess reserves when no individual commercial bank ever creates money in an amount greater than its excess reserve.

How do commercial banks make a profit?When banks have excess reserves, they loan it all to one borrower, who writes a check for entire amount to give to someone else, who deposits it at another bank. Define the monetary multiplier. Use the monetary multiplier and the amount of excess reserves to compute the money-creating potential of the banking system. Illustrate with an example using the monetary multiplier how money can be destroyed in the banking system. Discuss how bank panics during the early s led to a contraction of the nation's money supply, and worsened economic conditions Last Word.

More than banks failed in 3 years -As people withdrew funds, this reduced banks' reserves and, in turn, their landing power fell significantly -Contraction of excess reserves leads to multiple contraction in the money supply.