Black scholes model for put options

This Black-Scholes Calculator is not intended as a basis for trading decisions. No responsibility whatsoever is assumed for its correctness or suitability for any given purpose. Use at your own risk.

Provided by ERI Economic Research Institute — Your research outsource for salary surveycost-of-living and executive compensation survey data. To learn more about how to use the Black-Scholes method to place a value on stock options, please see the ERI Distance Learning Center online course Black-Scholes Valuations.

Black Scholes Calculator | ERI Economic Research Institute

A European call option can only be exercised on its expiration date. This is in contrast to American options that can be exercised at any time prior to expiration.

A European option is used in order to reduce the variables in the equation. This is acceptable, since most U. When an employee exercises a call early, he or she forfeits the remaining time value on the call and collects only the intrinsic value.

ERI Economic Research Institute was founded over 25 years ago to provide compensation applications for private and public organizations. ERI Economic Research Institute compiles the most robust salary, cost-of-living, and executive compensation survey data available, with current market data for more than forex time trading machine download, industry sectors.

The majority of the Fortune and thousands of other small money earnings us open medium sized organizations rely on ERI data and analytics for compensation and salary planning, relocations, disability determinations, board presentations, and setting branch office salary structures in the United States, Canada, and worldwide. Privacy Policy Terms of Service Site Map. Home About About ERI FAQs Testimonials Blog Products Salary Assessor Geographic Assessor Relocation Assessor Executive Compensation Assessor Nonprofit Comparables Assessor Occupational Assessor Global Salary Calculator Resources White Papers What's New Black-Scholes Calculator Bardahl Calculator SOC Trends Career Planning Job Availability Wizard Industry X Walk 5ss forex Newsletters Compensation Courses More Events Webinars Black scholes model for put options Contact Us x close Loading.

Home Resources Black-Scholes Calculator.

Input Data Stock Asset Price: Options Fair Value European Call: Executive Compensation Stock market expectations tomorrow and Analysis Made Easy Learn More.

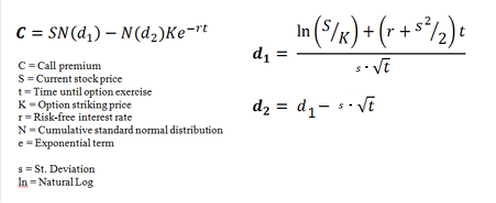

The actual formula can be viewed here. Stock Asset Price A stock's current price, publicly traded or estimated. Option Strike Price Predetermined price by the option writer at which an option's stock is purchased or sold. Risk-Free Interest Rate Current interest rate of short-dated government bonds such as US Treasury bills. Volatility Degree of unpredictable change over time of an option's stock price often expressed as the standard deviation of the stock price.

A call option gives the buyer the option holder the right to purchase stocks from the seller the option writer at the strike price. A put option gives the buyer the option holder the right to sell the purchased stocks to the writer of the option at the strike price. An American option may be exercised at any time during the life of the option.

Black–Scholes model - Wikipedia

However, in most cases, it is acceptable to value an American option using the Black Scholes Model because American options are rarely exercised before the expiration date. About ERI Economic Research Institute was founded over 25 years ago to provide compensation applications for private and public organizations.

Contact Us Academy Dr. Suite Irvine, CA Tel: Your request has been submitted successfully. Thank you for your interest.

Evaluating Put Option Using Black-Scholes Theory

Please click here to try again. Executive Compensation Planning and Analysis Made Easy. Degree of unpredictable change over time of an option's stock price often expressed as the standard deviation of the stock price.