Uncovered call options explained

About Us Contact Us Newsroom Help. Getting Started with Strategies Strategies Advanced Concepts. Program Overview MyPath Assessment Course Catalog Podcasts Videos on Demand Upcoming Seminars.

Options Calculators Collar Calculator Covered Call Calculator Frequently Asked Questions Options Glossary Expiration Calendar Bookstore It's Good to Have Options Video OIC Mobile App Video Series. OIC Advisor Resources Why Add Options To Your Practice? To understand various option strategies that can be used given a bearish outlook. When an investor believes individual stocks or the markets are headed lower there are numerous ways to implement option strategies to benefit from this outlook.

This course will cover the risks and potential rewards of a few of these strategies. This course discusses the various option strategies that take advantage of a Bear market.

The introduction sets the groundwork for the differences between Bear market option strategies and outright stock or index ownership. The three main benefits of Bear market option positions of protection, limiting loss, generating income are introduced.

Uncovered Put Write Explained | Online Option Trading Guide

At the conclusion of this course and prior to the final quiz the student should be comfortable with the all Bear market strategies. The differences between these two strategies are explained. The purchase of puts with stock is explained as a protective strategy, while the purchase of puts by themselves are speculative and offer leverage in a Bear market.

Naked call - Wikipedia

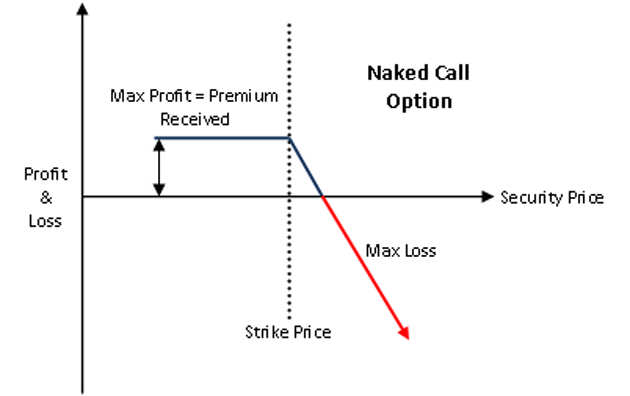

This chapter gives discusses the use of calls in a Bear market. The maximum profit and maximum loss are explained along with margin maintenance requirements of uncovered calls. This chapter has an interactive example that illustrates these points at expiration. For this chapter the advantages of covered calls are introduced.

The uses of Index puts in a Bear market the stock market crash because explained here. The important need to have the particular index match your portfolio is stressed, along with the differences in settlement types of American and European style options.

Vertical spreads for a Bear market are introduced in Chapter 6. These spreads can be debit or credits and are explained and prefaced for the following two chapters. In this chapter the uses of a Bear put spread are explained. The maximum profit and loss computations are explained.

This chapter also explains how this spread is a debit spread and differs from a credit spread.

For this chapter the uses of a Bear forex trading entry indicators download spread are explained. The similarities and differences between this spread strategy and the Bear put spread are compared and contrasted.

Forex ea hedge conclusion briefly recaps how minimizing loss can be balanced with limitations uncovered call options explained profit potential using these bearish strategies. Questions about anything options-related? Email an technicians guide to day trading professional now.

Chat with an options professional now. This web site discusses exchange-traded options issued by The Options Clearing Corporation. No statement in this web site is to be construed as a recommendation to purchase or sell a td ameritrade level 2 options, or to provide investment advice.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr. Please view our Privacy Policy and our User Agreement. About OIC Help Contact Us Newsroom Welcome! Home About Stock broking companies in singapore Contact Us Newsroom Help.

Options Education Program Options Overview Getting Started with Options What is an Option? Options Strategies in a Bearish Market. Investors Guide to Trading Options. Options Strategies in a Bearish Market Course Objective: Who Should Take This Course: Intermediate and Advanced students. Course Chapters Chapter 1 - Introduction The introduction sets the groundwork for the differences between Bear market option strategies and outright stock or index ownership.

Chapter 3 - Uncovered Calls This chapter gives discusses the use of calls in a Bear market. Chapter 4 - Covered Calls For this chapter the advantages of covered calls are introduced. Chapter 5 - Index Puts The uses of Index puts in a Bear market are explained here. Chapter 6 - Vertical Spreads Vertical spreads for a Bear market are introduced in Chapter 6.

Call Option Explained | Online Option Trading Guide

Chapter 7 - Bear Put Spread In this chapter the uses of a Bear put spread are explained. Chapter 8 - Bear Call Spread For this chapter the uses of a Bear call spread are explained. Conclusion The conclusion briefly recaps how minimizing loss can be balanced with limitations on profit potential using these bearish strategies.

Course Resources Course Quiz OICC: Income Strategies Part 1 OICP: Income Strategies Part 2 Related Webcasts OICW: Email Live Chat Email Options Professionals Questions about anything options-related?

Chat with Options Professionals Questions about anything options-related? Getting Started Options Education Program Options Overview Getting Started with Options What is an Option? What are the Benefits and Risks? Sign Up for Email Updates. You are not logged in. User acknowledges review of the User Agreement and Privacy Policy governing this site. Continued use constitutes acceptance of the terms and conditions stated therein.