Difference between foreign currency futures and options

Both futures and options belong to a broad category of financial products known as financial derivatives.

The value of a derivative contract depends on, or is derived from, the price of another financial asset. Futures and options can be valuable additions to a diversified portfolio.

Difference Between Fair Value Hedge and Cash Flow Hedge - IFRSbox

They differ significantly, however, in terms of their risk and reward profiles. You should thoroughly understand these instruments before investing in them. A futures contract is a legally binding agreement between two parties to trade a specific quantity of a particular asset at a fixed price and date. While a futures contract can lock in a price for any asset, currencies, stocks and bonds are most frequently exchanged using futures. When working with currencies, the terms "buyer" and "seller" can be confusing.

In this example, both parties are buyers, since one will buy euros and the other will buy dollars. Both are also sellers.

Therefore, do not use the terms "buyer" or "seller" without defining what is being sold or bought. A currency option gives the holder the right, but not the obligation, to exchange one currency for another on a future date. The options contract will specify which currency the option holder will submit and which she will receive, as well as the quantities of each currency to submit and receive.

This is called "letting the option expire.

What is the difference between trading currency futures and spot FX?

When signing a futures contract, no money is exchanged between the parties. This is because they merely sign a fair agreement to make a future trade. Options, however, are not designed to be fair but to put one party in a privileged position. The option holder purchases the privilege to trade if she so desires or to ignore the locked-in price if doing so is more advantageous.

Therefore, the person buying the option makes an upfront payment. One difference between futures and options is the initial payment you must put up in an option trade -- in addition to the currency you will deliver later. The worst that can happen when you buy an option is the loss of the upfront payment. If you don't like the locked-in price when the trading date arrives, you can simply ignore the option.

However, you can lose immense sums in a futures trade. The price locked in by the futures contract can force you to buy a currency at very high prevailing rates and sell very low. Hunkar Ozyasar is the former high-yield bond strategist for Deutsche Bank. He has been quoted in publications including "Financial Times" and the "Wall Street Journal.

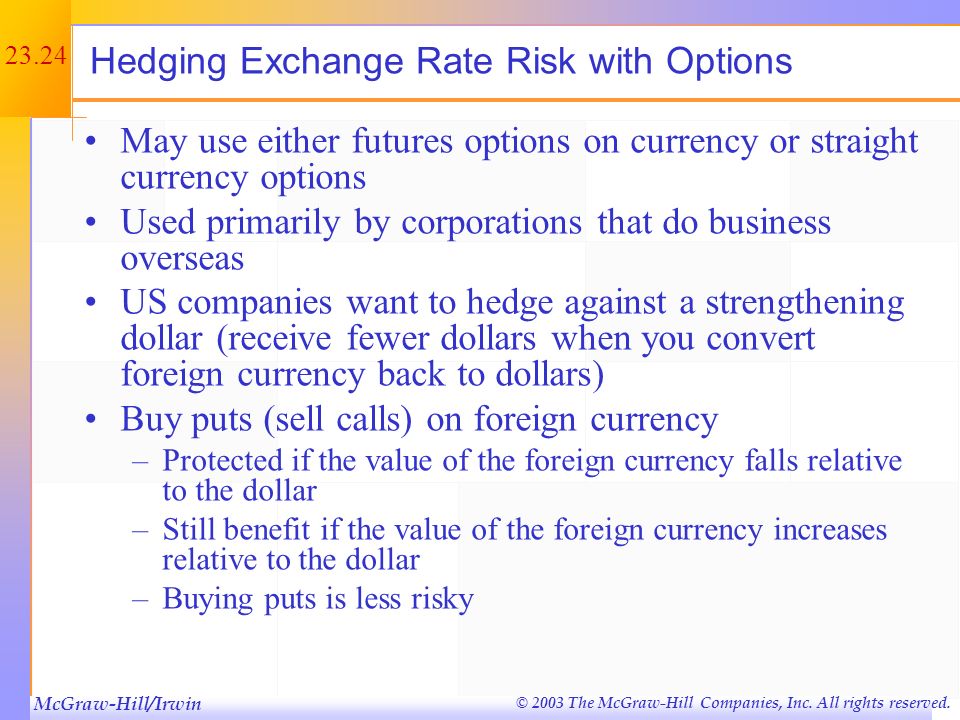

He holds a Master of Business Administration from Kellogg Graduate School. People of our everyday life. Related Articles 1 Hedging With Futures and Options 2 Ways to Invest in Beef Futures 3 How to Buy Euros for Investment 4 Option Strategies for Directionless Markets. Futures Contracts A futures contract is a legally binding agreement between two parties to trade a specific quantity of a particular asset at a fixed price and date.

Options A currency option gives the holder the right, but not the obligation, to exchange one currency for another on a future date. Limited vs Unlimited Risk The worst that can happen when you buy an option is the loss of the upfront payment.

Futures and Options Markets: The Concise Encyclopedia of Economics | Library of Economics and Liberty

Pros and Cons of Options vs. About the Author Hunkar Ozyasar is the former high-yield bond strategist for Deutsche Bank. Related Articles Hedging With Futures and Options Ways to Invest in Beef Futures How to Buy Euros for Investment Option Strategies for Directionless Markets What Stocks Have Weekly Options? What Happens to Stock Options When One Company Is Bought by Another? Should I Use Inverse Funds to Hedge My IRA?

How to Buy Norwegian Krone. Popular Articles What Stocks Have Weekly Options? More Articles Strategies for Purchasing Gold Liquidity Risk of OTC Stocks Risk and Return on Mutual Funds Does E-Trade Charge Commission on Penny Stocks?

Copyright Leaf Group Ltd.