What happens to the stock market during deflation

This article is part of a syndicated series about deflation from market analyst Robert Prechter, the world's foremost expert on and proponent of the deflationary scenario. For more on deflation and how you can survive it, download Prechter's FREE page Deflation Survival eBook , part of Prechter's NEW Deflation Survival Guide.

The following article was adapted from Robert Prechter's NEW Deflation Survival eBook , a free page compilation of Prechter's most important teachings and warnings about deflation. The worst thing about real estate is its lack of liquidity during a bear market. At least in the stock market, when your stock is down 60 percent and you realize you've made a horrendous mistake, you can call your broker and get out unless you're a mutual fund, insurance company or other institution with millions of shares, in which case, you're stuck.

With real estate, you can't pick up the phone and sell.

You need to find a buyer for your house in order to sell it. In a depression, buyers just go away. Mom and Pop move in with the kids, or the kids move in with Mom and Pop.

What does deflation mean to investors?

People start living in their offices or moving their offices into their living quarters. In time, there is a massive glut of real estate. At some point during a financial crisis, money flows typically become a political issue. You should keep a sharp eye on political trends in your home country. In severe economic times, governments have been known to ban foreign investment, demand capital repatriation, outlaw money transfers abroad, close banks, freeze bank accounts, restrict or seize private pensions, raise taxes, fix prices and impose currency exchange values.

They have been known to use force to change the course of who gets hurt and who is spared, which means that the prudent are punished and the thriftless are rewarded, reversing the result from what it would be according to who deserves to be spared or get hurt.

In extreme cases, such as when authoritarians assume power, they simply appropriate or take de facto control of your property. You cannot anticipate every possible law, regulation or political event that will be implemented to thwart your attempt at safety, liquidity and solvency.

Best Investments During Deflation ~ market folly

This is why you must plan ahead and pay attention. As you do, think about these issues so that when political forces troll for victims, you are legally outside the scope of the dragnet. If there is one bit of conventional wisdom that we hear repeatedly with respect to investing for a deflationary depression, it is that long-term bonds are the best possible investment.

This assertion is wrong. Any bond issued by a borrower who cannot pay goes to zero in a depression.

In the Great Depression, bonds of many companies, municipalities and foreign governments were crushed. They became wallpaper as their issuers went bankrupt and defaulted. Bonds of suspect issuers also went way down, at least for a time. Understand that in a crash, no one knows its depth, and almost everyone becomes afraid. That makes investors sell bonds of any issuers that they fear could default. Even when people trust the bonds they own, they are sometimes forced to sell them to raise cash to live on.

For this reason, even the safest bonds can go down, at least temporarily, as AAA bonds did in and Avoid long-term employment contracts with employees. Try to locate in a state with "at-will" employment laws. Red tape and legal impediments to firing could bankrupt your company in a financial crunch, thus putting everyone in your company out of work. If you run a business that normally carries a large business inventory such as an auto or boat dealership , try to reduce it.

If your business requires certain manufactured specialty items that may be hard to obtain in a depression, stock up. If you are an employer, start making plans for what you will do if the company's cash flow declines and you have to cut expenditures.

Would it be best to fire certain people? Would it be better to adjust all salaries downward an equal percentage so that you can keep everyone employed? Finally, plan how you will take advantage of the next major bottom in the economy. Positioning your company properly at that time could ensure success for decades to come.

Collecting for investment purposes is almost always foolish. Never buy anything marketed as a collectible. The chances of losing money when collectibility is priced into an item are huge. Usually, collecting trends are fads. They might be short-run or long-run fads, but they eventually dissolve.

If you have no special reason to believe that the company you work for will prosper so much in a contracting economy that its stock will rise in a bear market, then cash out any stock or stock options that your company has issued to you or that you bought on your own. If your remuneration is tied to the same company's fortunes in the form of stock or stock options, try to convert it to a liquid income stream.

Make sure you get paid actual money for your labor. If you have a choice of employment, try to think about which job will best weather the coming financial and economic storm. Then go get it. Perhaps the number one precaution to take at the start of a deflationary crash is to make sure that your investment capital is not invested "long" in stocks, stock mutual funds, stock index futures, stock options or any other equity-based investment or speculation.

That advice alone should be worth the time you [spend to read Conquer the Crash].

What Is the Effect of Economic Deflation on Stocks & Bonds? | Finance - Zacks

These are the early casualties of debt, leverage and incautious speculation. Have you lent money to friends, relatives or co-workers? The odds of collecting any of these debts are usually slim to none, but if you can prod your personal debtors into paying you back before they get further strapped for cash, it will not only help you but it will also give you some additional wherewithal to help those very same people if they become destitute later.

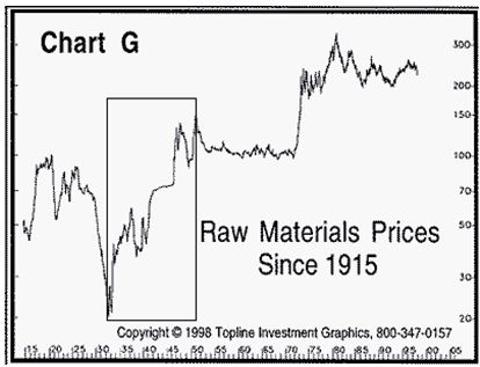

If at all possible, remain or become debt-free. Being debt-free means that you are freer, period. You don't have to sweat credit card payments. You don't have to sweat home or auto repossession or loss of your business. You don't have to work 6 percent more, or 10 percent more, or 18 percent more just to stay even. Pay particular attention to what happened in , the three years of intense deflation in which the stock market crashed. As you can see, commodities crashed, too.

You can get rich being short commodity futures in a deflationary crash. This is a player's game, though, and I am not about to urge a typical investor to follow that course.

If you are a seasoned commodity trader, avoid the long side and use rallies to sell short. Make sure that your broker keeps your liquid funds in T-bills or an equally safe medium. There can be exceptions to the broad trend. A commodity can rise against the trend on a war, a war scare, a shortage or a disruption of transport. Oil is an example of a commodity with that type of risk. This commodity should have nowhere to go but down during a depression.

For those among the public who have recently become concerned that being fully invested in one stock or stock fund is not risk-free, the analysts' battle cry is "diversification.

Advocates of junk bonds likewise counsel prospective investors that having lots of different issues will reduce risk. This "strategy" is bogus.

Why invest in anything unless you have a strong opinion about where it's going and a game plan for when to get out? Diversification is gospel today because investment assets of so many kinds have gone up for so long, but the future is another matter. Owning an array of investments is financial suicide during deflation. They all go down, and the logistics of getting out of them can be a nightmare. There can be weird exceptions to this rule, such as gold in the early s when the government fixed the price, or perhaps some commodity that is crucial in a war, but otherwise, all assets go down in price during deflation except one: For more on deflation, download Prechter's FREE page Deflation Survival eBook or browse various deflation topics like those below at www.

Bob Prechter, CMT Elliott Wave International. Robert Prechter , Jr. He is president of Elliott Wave International, a forecasting firm servicing institutional and private investors around the world. Since , Prechter has published the monthly Elliott Wave Theorist and has authored 14 books. His Elliott Wave Principle with A. Frost in predicted the great bull market.

His New York Times bestseller, Conquer the Crash , forecast a collapse of the global credit mania and the ensuing period of deflation. His two-book set, Socionomics , presents his seminal hypothesis that endogenously regulated waves of social mood determine the character of social actions.

Prechter attended Yale University on a full scholarship and graduated in with a degree in psychology.

Best Stocks for Deflation - Why Defensive Stocks Are Not Enough

He began his career as a Technical Market Specialist with the Merrill Lynch Market Analysis Department in New York City. View the entire course archive! The Contrarian Take http: Keep an eye out for new features coming soon the Safehaven. Keywords will help you find articles with relevant content faster and help you discover commentaries from authors you might not have previously! Robert Prechter Tue, Feb 10, Robert Prechter Bob Prechter, CMT Elliott Wave International Robert Prechter , Jr.

Course - 20 Stock and Investing Tips - from Your Prof Course - Wise Analysts: Others Course - Wise Analysts: Popular Topics Keep an eye out for new features coming soon the Safehaven. Please Read Our Disclaimer.